Introduction

A structured risk assessment framework ensures that all customers, whether individuals or corporate entities, are evaluated using standardised criteria that reflect current risks, geography, industry, and behaviour.

If you do not have a structured framework, you can encounter:

What the Regulators Say About the Risk-Based Approach

According to the Financial Action Task Force (FATF), the global standard-setter for AML/CTF, a risk-based approach is essential to effectively combat money laundering and terrorism financing. FATF explicitly states that institutions should ‘identify, assess, and understand the money laundering and terrorism financing risks’ they face, and take ‘proportionate measures’ to manage them.

A structured risk assessment framework helps organisations:

- Systematically assess customer risk in line with regulatory guidelines

- Maintain consistency across staff and departments

- Generate documentation that supports regulatory audits or reviews

By embedding this structure into day-to-day compliance activities, businesses not only protect themselves but demonstrate good faith and diligence to regulators.

What Does a Structured Risk Assessment Framework Look Like?

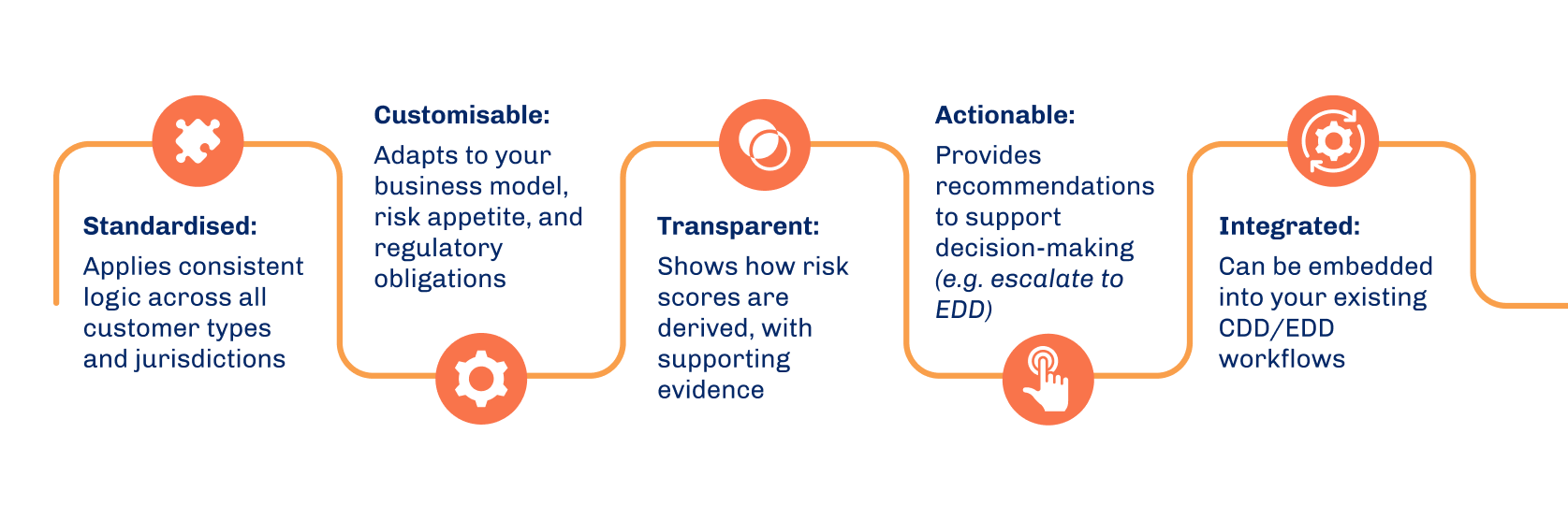

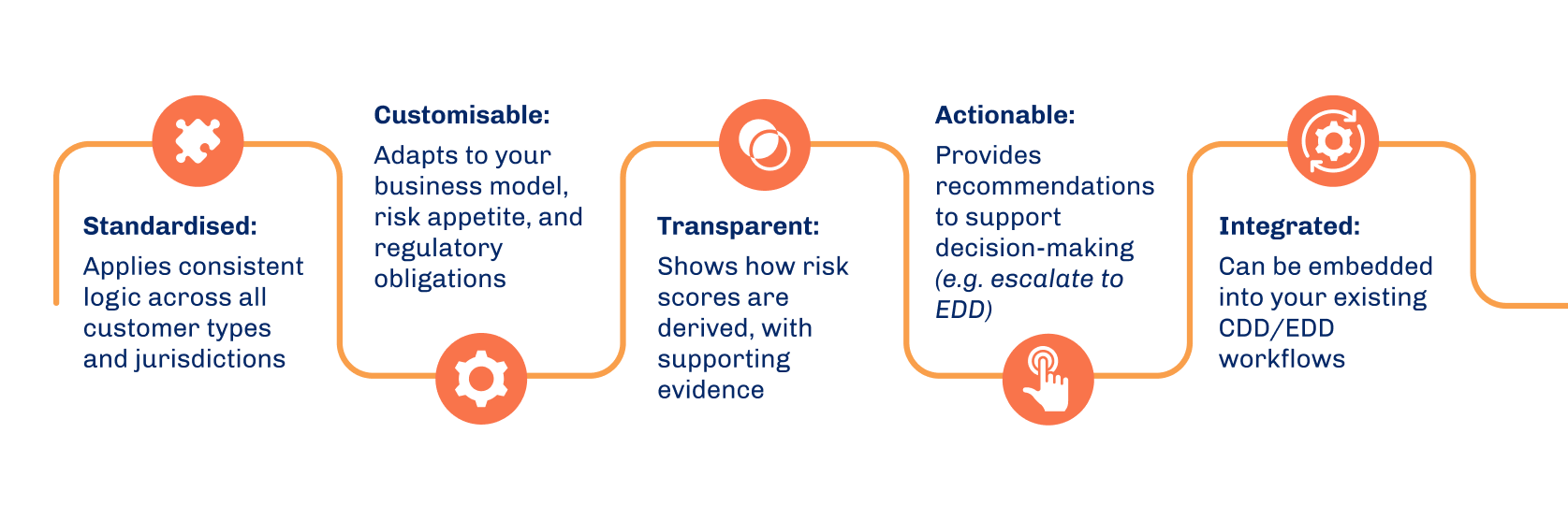

An effective risk framework should be:

This structured approach not only improves compliance outcomes but also boosts team efficiency, reduces false positives, and accelerates on boarding times.

How MemberCheck Can Help

At MemberCheck, we’ve designed our AML Risk Assessment tool to meet the growing demand for a smarter, more structured approach to risk evaluation.

With our solution, you can:

- Run a standalone risk assessment for both individuals and organisations

- Or combine it with PEP & Sanctions, ID Verification, or Know Your Business (KYB) scans for a richer profile

- Answer key questions about jurisdiction, industry, services, and screening outcomes

- Receive a calculated risk score, a risk level, and actionable recommendations

- View a transparent breakdown of how each answer contributed to the final score

- Use it across your onboarding, ongoing monitoring, or remediation processes

Whether you’re onboarding a new fintech client or evaluating a politically exposed individual, our tool helps your team stay consistent, compliant, and confident.

Final Thoughts

A structured risk assessment framework is no longer optional; it's a regulatory expectation and a business imperative. In an era where financial crime is becoming more sophisticated, your risk controls must evolve with it.

MemberCheck’s Risk Assessment tool empowers your team to move from reactive compliance to proactive risk management, turning regulatory pressure into a competitive advantage.

Want to see how it works? Book a demo today and start building a more resilient compliance framework.

FAQs

What is a structured risk assessment in AML compliance?

A structured risk assessment refers to a consistent, rules-based method of evaluating the risk level of a customer (individual or organisation). It uses defined criteria such as geography, industry, services used, and screening outcomes to assign a risk score and provide actionable recommendations.

Is risk assessment mandatory under AML laws?

Yes. Most AML/CTF regulations, including those enforced by FATF and AUSTRAC, require organisations to apply a risk-based approach. This includes conducting risk assessments to determine the appropriate level of customer due diligence (CDD or EDD).

How does risk assessment apply to high-risk industries like crypto, real estate, and legal services?

Industries such as cryptocurrency, property development, legal and accounting services, and financial advisory are often considered higher risk for money laundering. A structured risk assessment helps these businesses identify suspicious activity early, justify their decisions during audits, and tailor controls to their specific risk exposure.

How often should customer risk assessments be updated?

Risk assessments should be updated:

- At onboarding

- During significant changes in customer behaviour

- Periodically as part of ongoing monitoring (e.g. annually or based on risk tier)

Keeping assessments up to date is critical for ongoing AML compliance.