As a designated service provider, you must ensure that you have a rigorous anti-money laundering/counter-terrorism financing policy in place, which includes the following:

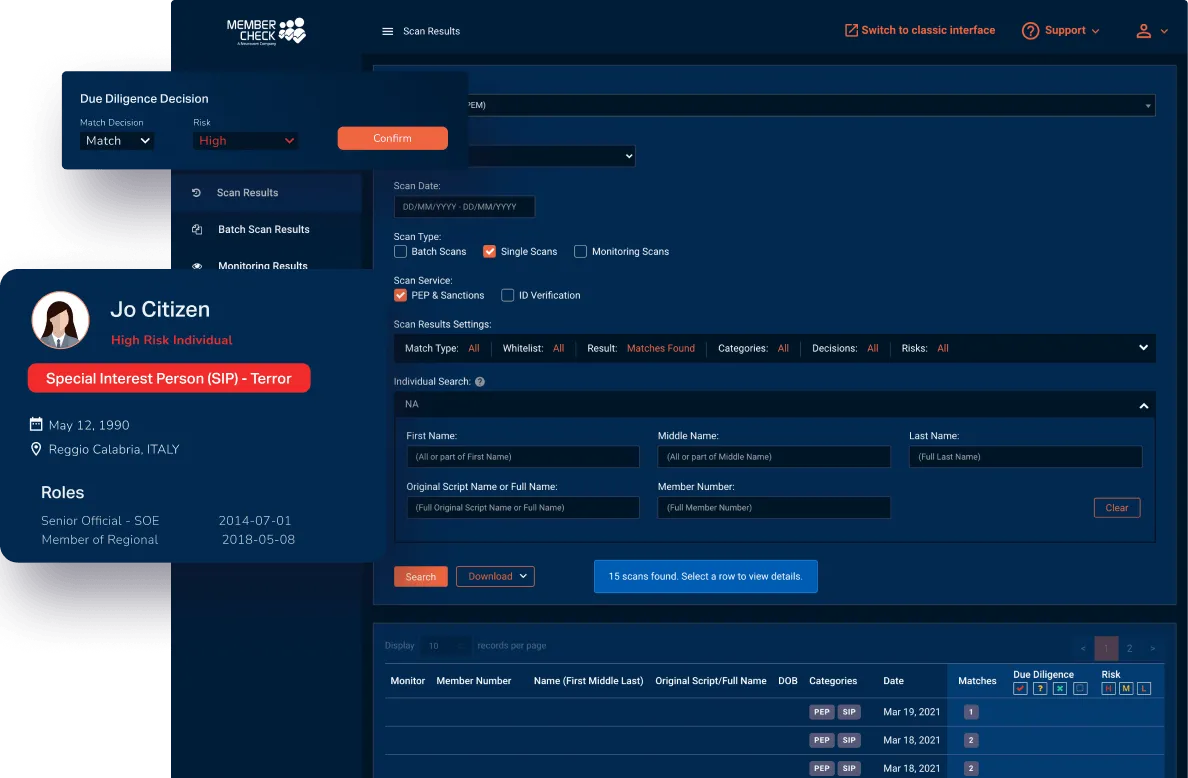

Establish consistent procedures for CDD, risk profiling, and monitoring to ensure successful implementation of AML/CFT measures

Implement proper management oversight, supervision, processes, controls, segregation of duties, and training

Determine and confirm the identity of ultimate beneficial owners, and also update your framework on a regular basis, and keep a list of high-ranking officials and politically exposed persons

Each registered entity should consider the unique nature of its market, corporate structure, clients and transaction types, and other factors when adopting initiatives and procedures to ensure their effectiveness.

By devising sound legal and institutional structures, organising incremental capacity building activities, and raising awareness among stakeholders and the general public, Nepal has made significant progress in layering the groundwork for the AML/CFT system.

All AML/CFT programs must be risk-based. The risk assessment serves as the foundation for your entire anti-money laundering/counter-terrorism financing program. Your program must demonstrate clearly the connections between defined risks and the processes, practises, and controls that address those risks.