AML/CFT Supervisors in the United States

Financial Crime Enforcement Network (FinCEN)

Financial Crime Enforcement Network (FinCEN) is the official anti-money laundering/counter-terrorist financing regulator in the United States. FinCEN is a Treasury Department bureau whose mission is to protect the financial system from illicit use, combat money laundering, and advance national security through the acquisition, study, and distribution of financial information and strategic use of financial authorities. FinCEN accomplishes its goal by collecting and storing financial activity data; interpreting and disseminating the data for law enforcement purposes; and fostering global collaboration with counterpart agencies of other countries and foreign bodies.

The Office of Foreign Assets Control (OFAC)

The Office of Foreign Assets Control (OFAC) imposes economic and trade sanctions in accordance with US foreign policy and national security objectives against designated foreign governments and regimes, terrorists, international drug smugglers, others involved in actions relating to the proliferation of weapons of mass destruction, and those that pose a threat to the United States' national security, foreign policy, or economy.

AML/CFT reporting obligations in the United States

The Bank Secrecy Act and the USA Patriot Act are the two main AML Regulations.

Bank Secrecy Act (BSA)

Bank Secrecy Act (BSA) is the first and most stringent anti-money laundering and counter-terrorism funding (AML/CFT) act of the United States. The BSA empowers the Secretary of the Treasury to issue regulations requiring banks and other financial firms to take precautions against financial fraud, including the implementation of anti-money laundering (AML) schemes that provide adequate consumer due diligence (CDD), monitoring, reporting and record-keeping.

USA Patriot Act

USA Patriot Act (Uniting and Strengthening America by the Provision of Appropriate Tools Required to Intercept and Obstruct Terrorism) was enacted in 2001 in response to the September 11 terrorist attacks. The USA PATRIOT Act's aim is to prevent and prosecute terrorist attacks committed in the United States and around the world, to strengthen law enforcement investigative tools, and to accomplish other objectives. This act broadens the reach of the BSA and bestows greater surveillance authority on law enforcement agencies.

How to comply with the BSA and USA Patriot Acts?

Under the Bank Secrecy Act and related anti-money laundering laws, banks and other financial institutions must:

Include a system of internal controls to assure ongoing compliance; provide for independent testing for compliance; designate an individual responsible for coordinating and monitoring day-to-day compliance; and provide training for appropriate personnel

Establish effective customer due diligence systems and monitoring programs

Screen against Office of Foreign Assets Control (OFAC) and other government lists

Establish an effective suspicious activity monitoring and reporting process

Develop risk-based anti-money laundering programs

Customer Due Diligence (CDD) and Customer Identification Program (CIP) Programs

Keep records of cash purchases of negotiable instruments

File reports of cash transactions exceeding $10,000 (daily aggregate amount)

Report suspicious activity that might signal criminal activity (e.g., money laundering, tax evasion)

AML/CFT Reporting Obligations in the United States

BSA regulations require financial institutions to submit different reports. Notable reporting obligations include:

Currency Transaction Reports (CTR)

Report cash transactions exceeding $10,000 in one business day, regardless of whether it is in one transaction or several cash transactions. Reports are filed electronically with the Financial Crimes Enforcement Network (FinCEN) and identified as FinCEN Form 112 (formerly Form 104).

Suspicious Activity Reports (SAR)

Any cash transaction where the customer seems to be trying to avoid BSA reporting requirements by not filing CTR or monetary instrument log (MIL), for example, must be reported. A SAR must also be filed if the customer's actions suggest that they are laundering money or otherwise violating federal criminal laws and committing wire transfer fraud, cheque fraud, or there is a mysterious disappearance. These reports are filed with FinCEN and are identified as Treasury Department Form 90-22.47 and OCC Form 8010-9, 8010-1.

Cash Purchases of $3,000-$10,000, inclusive

Money Services Businesses(MSB) that sell money orders or traveller’s cheques are required to record cash purchases involving $3,000-$10,000, inclusive. Multiple cash purchases of monetary instruments totalling $3,000 or more must be treated as one purchase which must be recorded if they are made at the same time, or The MSB has knowledge that such purchases occurred during one business day.

Money Transfers of $3,000 or more

MSBs that provide money transfer services must obtain and record specific information for each money transfer of $3,000 or more, regardless of the method of payment. They must keep the record for 5 years from the date of the transaction.

Currency Exchanges of more than $1,000

Currency exchangers must keep a record of each exchange totalling more than $1,000 in either domestic or foreign currency, and keep the record for 5 years from the date of transaction.

Foreign Bank Account Reports (FBAR)

Citizens and residents with a financial interest in, or authority over, foreign bank accounts or foreign financial accounts with an aggregate value of $10,000 are required to file an FBAR with the U.S. Treasury by October 15 every year. It is identified as FinCEN Form 114 (formerly Treasury Department Form 90-22.1). Additionally, they must report the accounts on Schedule B of the Form 1040 tax form.

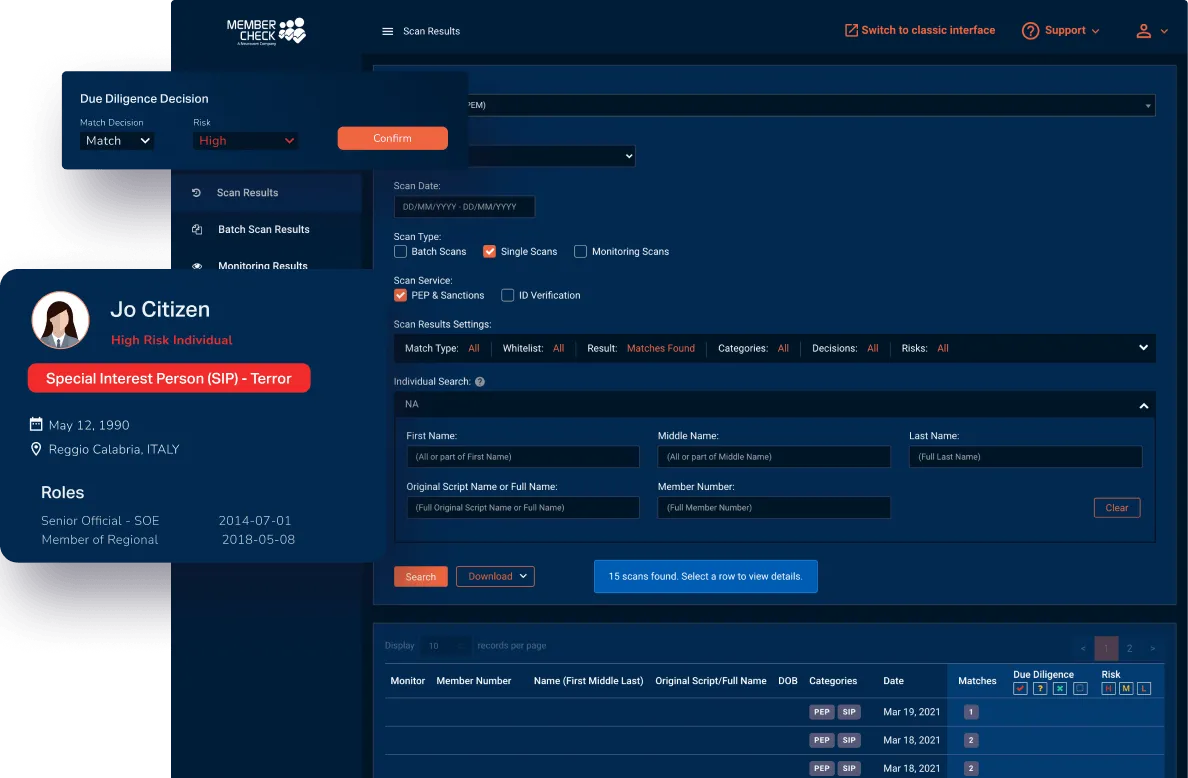

How can MemberCheck Help?

Our clients are provided with a secure and simple solution in regard to scanning for politically exposed or high-risk individuals, as well as checking names against sanction, regulatory, law enforcement, and other official lists.

Use our sophisticated scan filters and due diligence workflow to minimise the amount of time you spend sorting through, false matches. Scan results and reporting sections allow you to access customer details, whenever and wherever required, as well as download reports, to customise for further investigation or to provide evidence of your AML program compliance for auditing purposes.

* This page is intended as general information only and should not be relied on as the sole source of information for your AML obligations and AML program. Please visit your local regulatory authority sites for the latest relevant and full information.