Statutory AML/CTF Supervisors in Czech Republic

The Financial Analytics Office (FAU)

The Financial Analytics Office (FAU) is the main AML/CTF Supervisory authority in the Czech Republic. The FAU established a supervision division which closely cooperates with the supervision department of the Czech National Bank, covering the supervision of banks, credit unions, pension funds, investment funds, insurance companies and all capital market entities.

Other authorities with responsibility to monitor compliance with the key obligations under the AML Act in certain sections are as follows:

The Czech National Bank

The Ministry of Finance

The Czech Inspection Authority

How to comply with AML obligations in the Czech Republic?

The AML Act contains several key obligations that must be respected to the maximum extent by all reporting entities, individuals and legal entities.

There are almost 40 categories of reporting entities under the AML Act, including banks, financial institutions, operator of hazardous games, people active in the real estate industry as well as intermediaries in the field, notaries and attorneys.

The obligations that apply to you as a reporting entity include the following:

You must conduct customer due diligence (CDD)

Not conclude a business transaction in certain cases (e.g. when the customer refuses to be identified or that identification cannot be concluded)

Assess the risk of money laundering and terrorist financing to your business

Disclose information on suspicious operations, transactions, and customers

Develop a system of internal AML principles

Deliver AML training for respective employees at least once per year

Provide the FAU with the requested information on customers or business activities

The reporting entities that are subject to the Czech Republic AML legislation. This includes persons acting (within their business capacity) as trustees of trusts are obliged to keep records of all data and documents on all transactions within a business relationship (including transactions between a trustee and a settlor or beneficiary) for a period of at least ten 10 years.

In March 2021, the Czech Republic AML Act was amended to include obligations for persons buying or selling real estate and/or acting as real estate brokers.

What are my AML/CTF Reporting obligations?

As an AML reporting entity, you have reporting obligations related to the cross-border transfer of funds. In addition, you must notify the FAU of any suspicious transactions that you have identified.

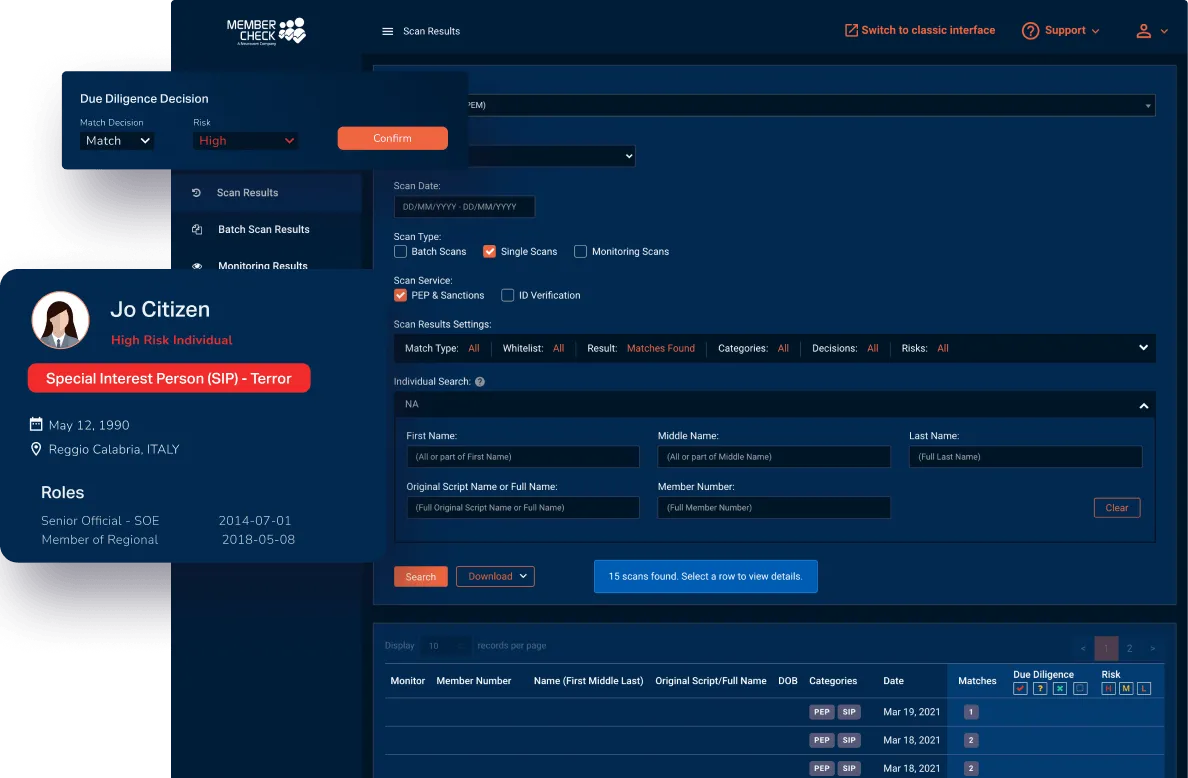

How can MemberCheck Help?

Our clients are provided with a secure and simple solution in regard to scanning for politically exposed or high-risk individuals, as well as checking names against sanction, regulatory, law enforcement, and other official lists.

Use our sophisticated scan filters and due diligence workflow to minimise the amount of time you spend sorting through, false matches. Scan results and reporting sections allow you to access customer details, whenever and wherever required, as well as download reports, to customise for further investigation or to provide evidence of your AML program compliance for auditing purposes.

* This page is intended as general information only and should not be relied on as the sole source of information for your AML obligations and AML program. Please visit your local regulatory authority sites for the latest relevant and full information.