AML/CFT Supervisors in Hungary

Hungarian Financial Intelligent Unit (FIU)

The central body in charge of receiving, analysing, disseminating suspicious transactions/activity reports is the Hungarian Financial Intelligent Unit (FIU).

In addition to the FIU, there are other authorities authorised to supervise the performance of reporting entities in relation to their AML obligations. The other authorities are as follows:

The National Bank of Hungary (MNB)

The National Bank of Hungary (MNB) is the supervisor of the financial intermediary system. The MNB supervises credit institutions, financial services institutions, institutions for occupational retirement provision, voluntary mutual insurance funds, operators accepting and delivering international postal money orders.

The Gaming Supervisory Authority

The Gaming Supervisory Authority supervises operators of casinos, card rooms, gambling services and online casino games.

Chamber of Hungarian Auditors

Chamber of Hungarian Auditors is tasked with the supervision of the providers of auditing services.

The Regional Association of Notaries

The Regional Association of Notaries supervises the registered notaries.

The Authority for Trade and Commerce

The Authority for Trade and Commerce supervises traders in precious metals or articles made of precious metals; traders ingoods involving a cash payment of or exceeding HUF 3m; service providers trading or acting as intermediaries in the trade of cultural goods.

The NAV (Nemzeti Ado’-e’s Vamhivatal)

The NAV (Nemzeti Ado’-e’s Vamhivatal) is responsible for providers of real estate agencies or brokering and any related services, book keepers,tax experts, tax advisers, providers engaged in exchange services between virtual currencies and legal tenders, custodian wallet providers and providers of corporate headquarters services.

How to comply with AML obligations in Hungary?

The AML obligations applicable to you as a reporting entity are as follows:

Conduct CDD (identification and verification of your customer) when establishing abusiness relationship

Collect and store information and documents

Continuously monitor the business relationship

Carry out a risk assessment and risk categorisation

Operate a screening system

Disclose (report) information on suspicious transactions

Operate a whistle blowing system

Provide AML training to your employees.

As per Hungary’s AML Act, you are required to retain data for no less than 8 years, which is part of your AML and KYC obligations for due diligence. In the case where this information is processed, collected, and managed by a relevant third-party. You are responsible for collecting all necessary information from the third-party without undue delay.

What are my AML/CTF Reporting obligations?

The directors, employees and contributing family members of your entity must report without delay, any information, fact or circumstance giving rise to asuspicion:

of money laundering

of terrorist financing; or

that specific property is derived from criminal activity.

The suspicious transaction or activity must be reported to the FIU.

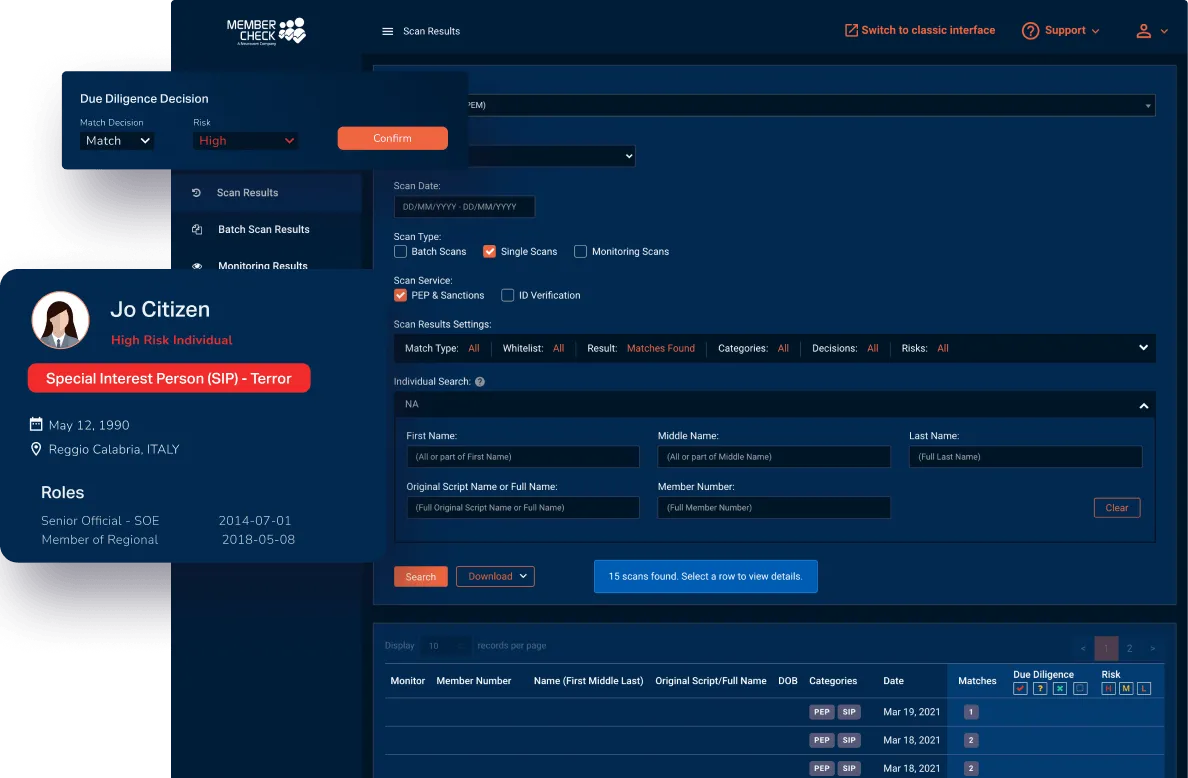

How can MemberCheck Help?

Our clients are provided with a secure and simple solution in regard to scanning for politically exposed or high-risk individuals, as well as checking names against sanction, regulatory, law enforcement, and other official lists.

Use our sophisticated scan filters and due diligence workflow to minimise the amount of time you spend sorting through, false matches. Scan results and reporting sections allow you to access customer details, whenever and wherever required, as well as download reports, to customise for further investigation or to provide evidence of your AML program compliance for auditing purposes.

* This page is intended as general information only and should not be relied on as the sole source of information for your AML obligations and AML program. Please visit your local regulatory authority sites for the latest relevant and full information.