AML/CFT Supervisors in Sweden

Financial Crime Enforcement Network (FinCEN)

AML/CFT supervision in Sweden is carried out by the Swedish Financial Supervisory Authority (SFSA). SFSA is a public authority whose primary function is to promote stability and efficiency in the financial system. In addition, SFSA provides protection for consumers by monitoring all entities that operate in the Swedish financial markets.

Advocates and associate lawyers are regulated, supervised, and monitored by the Swedish Bar Association.

How to comply with AML obligations in Sweden?

There are two primary laws aimed at money laundering in Sweden:

The Swedish AML and Terrorist Financing Law (Anti-Money Laundering Act) and

Money Laundering Crimes Criminal Code

Under the above laws, you must comply with the following requirements:

Perform an assessment of the risk of the products and services that you offer that maybe used for money laundering or terrorist financing, taking into account the customers and distribution channels together with the geographic risk factors

Adopt a risk-based approach

Develop and implement an AML Compliance Program

Develop and introduce an AML policy, procedures and guidelines in terms of measures for customer due diligence (CDD), monitoring, processing of personal data and other requirements to combat AML

Possessing solid knowledge about your customers and their affairs, so as to make it more difficult for the business to be used for, and to prevent money laundering or terrorist financing

Create your customer’s risk profile and take the necessary precautions against possible money laundering risks

Deliver training to your employees to equip them with sufficient knowledge to follow your entity’s AML procedures and guidelines

Review transactions in order to detect transactions and other activities that could be suspected to form an element of money laundering or terrorist financing.

In terms of record keeping, you must retain information about CDD measures for a period of 5 years. The period shall be calculated from the date the measures were taken or, in the case of a business relationship having been established, from the date the business relationship ended.

What are my AML/CFT Reporting obligations?

As a reporting entity, you are required to review and report suspicious transactions. Proof does not have to exist of money laundering or terrorist financing occurred. The report must be submitted without delay to the Financial Intelligence Unit.

How can MemberCheck Help?

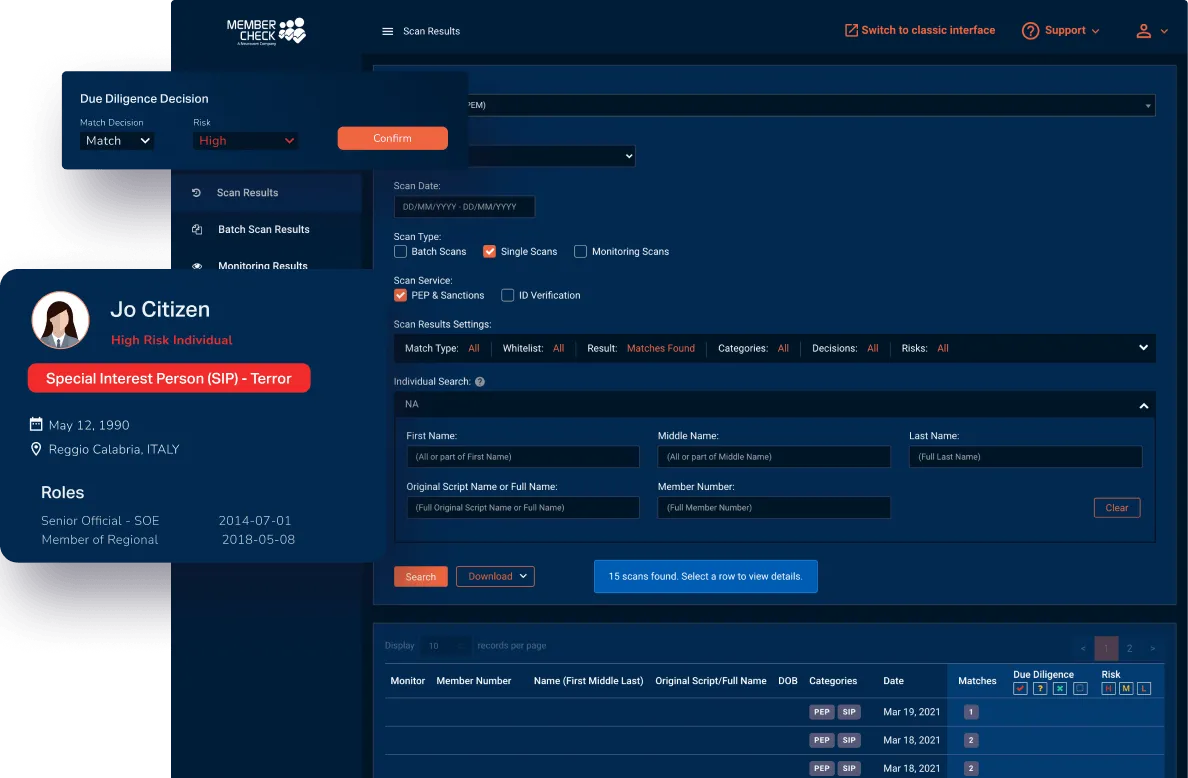

Our clients are provided with a secure and simple solution in regard to scanning for politically exposed or high-risk individuals, as well as checking names against sanction, regulatory, law enforcement, and other official lists.

Use our sophisticated scan filters and due diligence workflow to minimise the amount of time you spend sorting through, false matches. Scan results and reporting sections allow you to access customer details, whenever and wherever required, as well as download reports, to customise for further investigation or to provide evidence of your AML program compliance for auditing purposes.

* This page is intended as general information only and should not be relied on as the sole source of information for your AML obligations and AML program. Please visit your local regulatory authority sites for the latest relevant and full information.