AML/CFT Supervisors in Palestine

Financial Follow-Up Unit (FFU)

Financial Follow-Up Unit (FFU) was established as an independent body housed at the Palestine Monetary Authority (PMA) under the provisions of Article (19) of the Anti-Money Laundering Law of 2007. Its goals are to combat money laundering, safeguard the national economy from the negative effects of money laundering, strengthen anti-money laundering procedures and systems in Palestine, and promote cooperation among all local competent agencies. FFU is governed by the National Committee on Anti-Money Laundering, which creates policies aimed at preventing money laundering and establishing an effective combating system.

How to comply with AML/CTF regulations in Palestine?

In Palestine, the compliance requirements are recommended to be reflected in a compliance program that target the following:

Receipt and requests for information from entities subject to Palestine AML law on transactions suspected of constituting money laundering operations.

Information gathering and analysis.

Under the provisions of Palestine AML law, the dissemination of information and the results of information analysis on the proceeds of AML suspected crimes.

Obtaining information on sheltered financial transactions from a variety of official and non-official sources.

Information evaluation.

Run ongoing training for Compliance and Anti Financial Crime departments and Units, in order to leverage the human performance to be up to the international and local level of AML/CFT implementation requirements.

Information is delivered to the appropriate authorities and judicial agencies, in order to support them in the preparation of lawful action the prosecution of criminals.

Revealing banking secrecy within the confines of enforcing AML laws to deliver information to judicial bodies to aid in verifying processes and prosecuting criminals.

Suspicious Transaction Report

To have an efficient mechanism of reporting suspicious transitions, the following is recommended by Palestinian AML law:

Enhance internal cooperation in the reporting of suspicious transactions based on current and future national and international criteria, which is predefined by criteria or objectives.

When they enter into any cash transaction whose value matches or surpasses the value stipulated by the Country AML Committee. Precious metal and previous stone merchants, as well as dealers who conduct high value transactions, must report suspicious transactions to the FFU.

When completing real estate sale or purchasing transactions for their consumers, real estate agents and brokers must report questionable transactions to the FFU.

No legal action may be taken against financial institutions or non-financial firms and professions, or their managers, officials, or employees, for the execution of a suspicious transaction reported in good faith in accordance with the country's AML regulation.

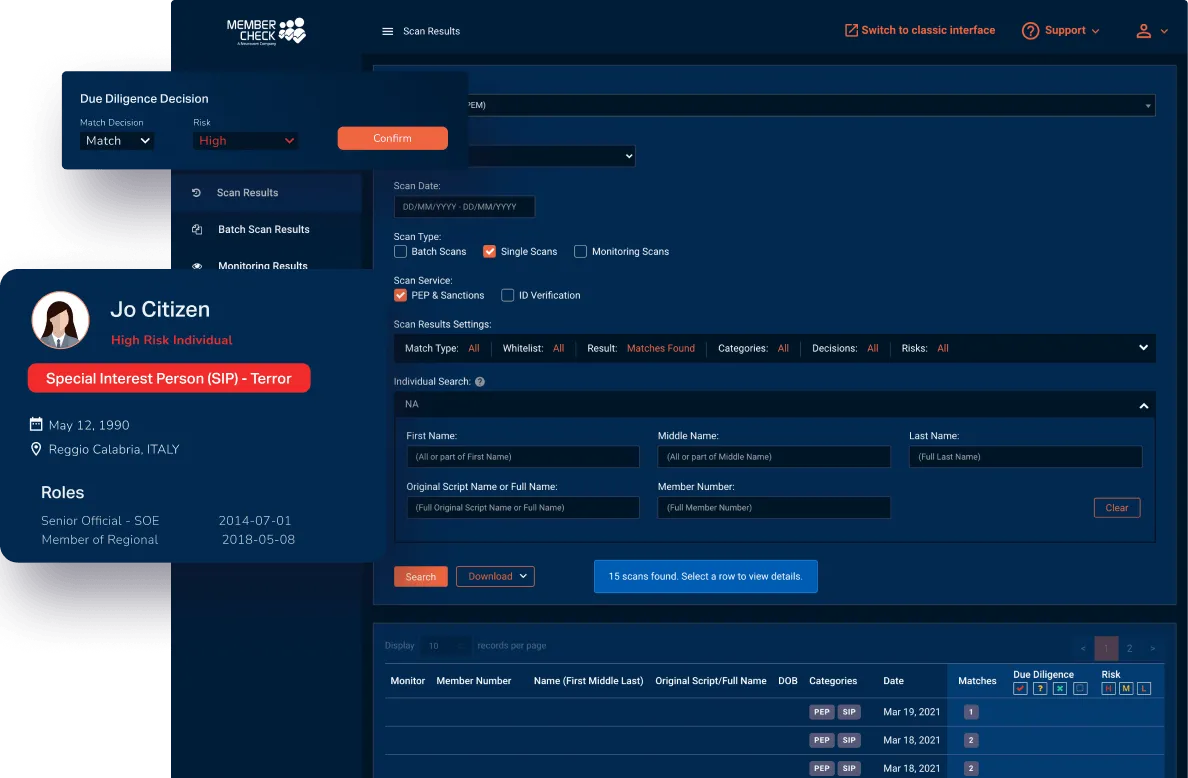

How can MemberCheck Help?

Our clients are provided with a secure and simple solution in regard to scanning for politically exposed or high-risk individuals, as well as checking names against sanction, regulatory, law enforcement, and other official lists.

Use our sophisticated scan filters and due diligence workflow to minimise the amount of time you spend sorting through, false matches. Scan results and reporting sections allow you to access customer details, whenever and wherever required, as well as download reports, to customise for further investigation or to provide evidence of your AML program compliance for auditing purposes.

* This page is intended as general information only and should not be relied on as the sole source of information for your AML obligations and AML program. Please visit your local regulatory authority sites for the latest relevant and full information.