Our Solutions

Solutions

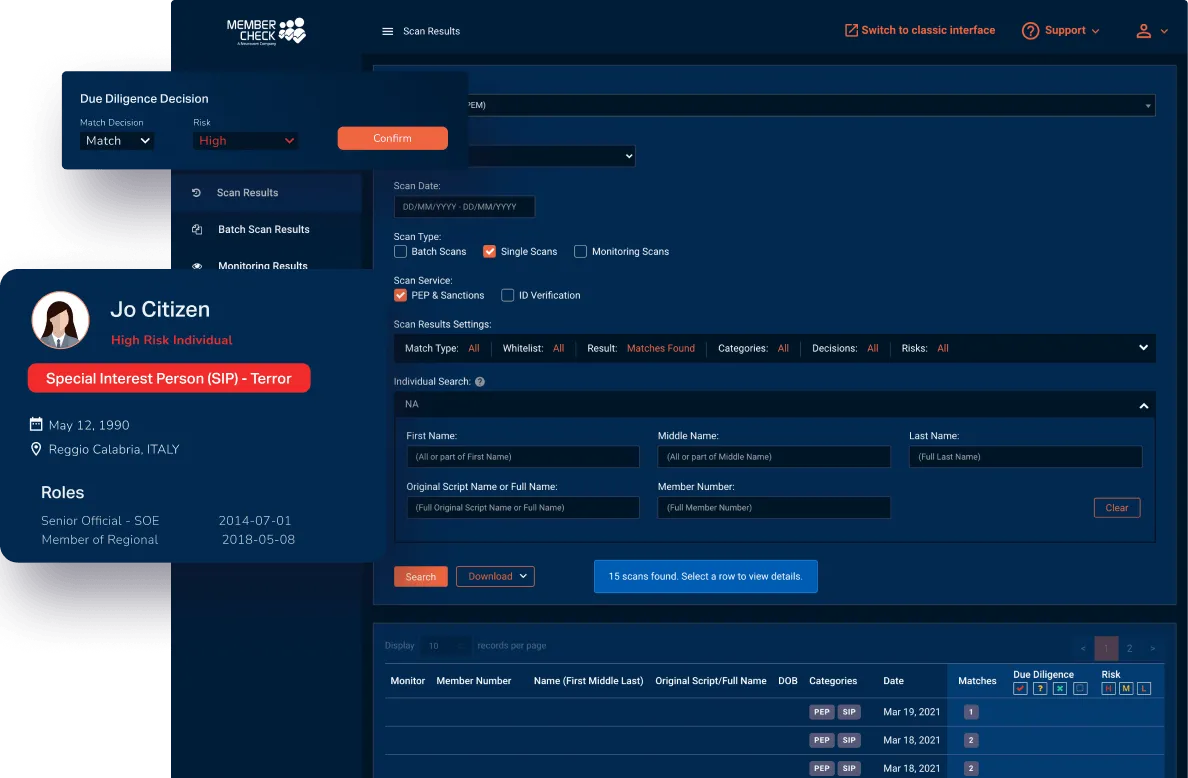

PEP and Sanctions Checks

Adverse Media Check

Customer Identity Verification

Know Your Business (KYB)

Enhanced Due Diligence

AML Consulting Service

Compliance as a Business (CaaB)

Transaction Monitoring

Jurisdictional Risk Checks

Our Coverage

Pricing

Blog

About

Contact Us

Sign In

-

ProductOur SolutionsFraud Prevention Solutions

-

Global Coverage

Australia

Canada

Kuwait

India

Egypt

Mexico

Nepal

New Zealand

Philippines

Puerto Rico

Russia

Singapore

South Africa

United States

United Kingdom

Hong Kong

United Arab Emirates

View All CountriesAccelerating Digitial Trust in the UKView Page -

ResourcesUse CasesCase StudiesIndustries We Work With

-

Tranche 2 ReformsTranche 2 ReformsChecklists

-

About

- Contact