Turkish AML/CTF supervisor

Turkish Financial Crimes Investigation Board - (MASAK)

The Turkish Financial Crimes Investigation Board (MASAK) is a financial intelligence agency under the Ministry of Finance and Treasury.

MASAK's primary role is to undertake analysis and sector specific studies on developments in the field of money laundering and strategies for preventing and exposing money laundering offences. MASAK is also involved with formulating policies, conducting investigations and audits and reporting on the findings of these investigations.

How to comply with AML/CTF regulations in Turkey

The law requires designated parties, especially financial companies, to perform due diligence on customers with whom they do business, to disclose transactions suspected of involving money laundering or terrorism financing to MASAK, and to maintain and provide pertinent information and records upon request.

The goal of responding to MASAK's requirements is to ensure that Turkey's legal system complies with international standards. The following are included in the requirements of the compliance program:

Onboarding principles

Due diligence principles for customers

Suspicious transaction reporting procedures

Documentation principles for keeping and submitting information

The necessity of independent audits

Notification to the Custom's administration

Turkish AML/CTF reporting obligations

Reporting suspicious transactions to MASAK is a compliance requirement

- MASAK must be notified of any suspicious transactions, regardless of their value.

- The term "transaction" does not have to refer to a single transaction and can refer to multiple transactions

- When multiple suspicious transactions are evaluated together, a single Suspicious Transaction Report (STR) form must be filled out

- Any "information," "suspicion," or "reasonable ground to suspect" is sufficient for reporting a suspicious transaction

- The "compliance officer" appointed by the Board of Directors is responsible for reporting suspicious transactions to MASAK

- Suspicious transactions must be reported to MASAK within ten working days of the suspicion arising, or immediately in cases where any delay would be inconvenient. This takes into account the time spent on internal reporting

- Finding any "information" about transactions and customers related to STRs in the press or other similar sources is clearly a situation that necessitates the submission of a STR

- Except for examiners assigned to supervision of obligations and courts during the judicial process, suspicious transaction reporting and relevant internal reports shall not be explained to anyone, including the parties to the transaction. Those who break this rule face a sentence of imprisonment ranging from one to three years, as well as a fine of up to $5,000

- When conducting transactions, MASAK shall not be mentioned as a reference to avoid misleading customers because MASAK does not have the authority or function to approve or cancel transactions under applicable legislation

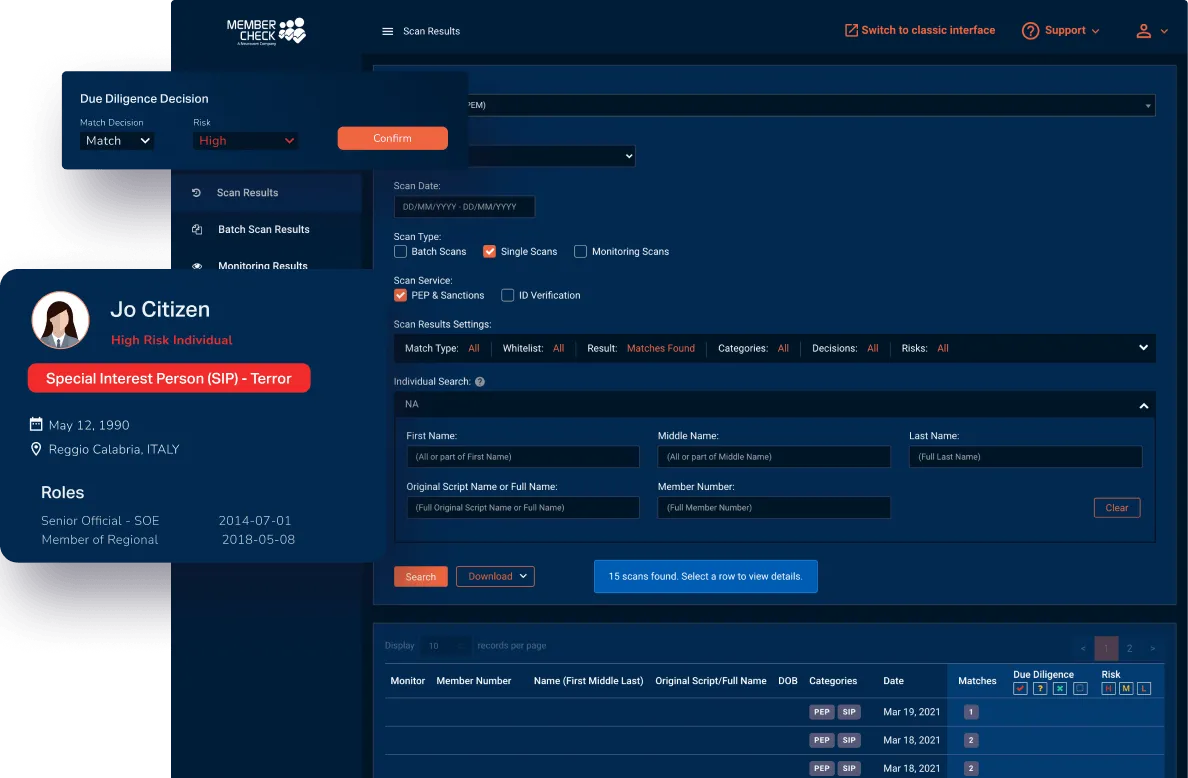

How can MemberCheck Help?

Our clients are provided with a secure and simple solution in regard to scanning for politically exposed or high-risk individuals, as well as checking names against sanction, regulatory, law enforcement, and other official lists.

Use our sophisticated scan filters and due diligence workflow to minimise the amount of time you spend sorting through, false matches. Scan results and reporting sections allow you to access customer details, whenever and wherever required, as well as download reports, to customise for further investigation or to provide evidence of your AML program compliance for auditing purposes.

* This page is intended as general information only and should not be relied on as the sole source of information for your AML obligations and AML program. Please visit your local regulatory authority sites for the latest relevant and full information.