AML/CFT Supervisors in Luxembourg

Luxembourg has a variety of laws and regulations to fight money laundering and terrorist financing. Supervisory authorities and self-regulated bodies ensure the effective monitoring of compliance by professionals with their AML obligations both periodically and when major events or developments in their management and operations occur.

In Luxembourg, three Supervisory authorities are responsible for ensuring compliance of the professional sector:

The Financial Sector Supervisory Commission (Commission de Surveillance du Secteur Financier - CSSF)

The CSSF is in charge of ensuring that all parties subject to the supervision, authorisation or registration with the professional AML/CTF obligations. The parties under the supervision of CSSF are credit institutions and professionals of the financial sector. Professionals are required to fully cooperate with the CSSF as well as the Cellule de Renseignement Financier (CRF), which is the Financial Intelligence Unit (FIU) of Luxembourg.

The Insurance Commission (CAA)

The Insurance Commission (CAA) is responsible for professionals of the insurance industry.

The Luxembourg Registration Duties, Estates and VAT Authority (AED) takes care of the professionals that do not fall under the supervision of the CSSF or any self-regulated body. In addition, there are also four self-regulated bodies that are composed of members of the profession they represent, monitor compliance and ensure the enforcement of the AML rules by professionals of their sector(i.e. audit and accountancy professionals, notaries and lawyers).

The FIU was established within the Luxembourg Ministry of Justice. All organisations obliged to comply with the AML/CFT regulations must create a suspicious transaction report (STR) for any activity involving money laundering risk and report it to the CRF.

How to comply with AML obligations in Luxembourg?

As a financial sector professional in Luxembourg, you must comply with the professional obligations arising from AML/CTF Act, and more specifically customer due diligence (CDD) obligations, adequate internal management requirements and cooperate with the authorities.

In addition, you are also required to set up compliance programmes that include:

Developing internal policies, controls, and procedures

Appointing a compliance officer at an appropriate hierarchical level

Record-keeping

Customer due diligence

Internal controls and where appropriate, an independent audit function

Employee screening

The professionals and institutions that are subject to professional obligations in Luxembourg include:

Credit institutions and professionals within the financial sector

Insurance undertakings and professionals within the insurance sector

Certain pension funds

Undertaking for collection investment and investment companies in risk capital, as well as their management companies

Trust and company services providers

Statutory and approved auditors, , audit firms and accountants

Real estate agents

Legal professionals in the scope of certain activities (such as bailiffs, lawyers or notaries)

Providers of gambling services

What are my AML/CFT reporting obligations?

In terms of your reporting obligations (including your directors and employees), you are required to report to the FIU all suspicious transactions (even if only attempted) regardless of their amount, that are suspected to be related to money laundering, an associated predicate offence or terrorist financing.

How can MemberCheck Help?

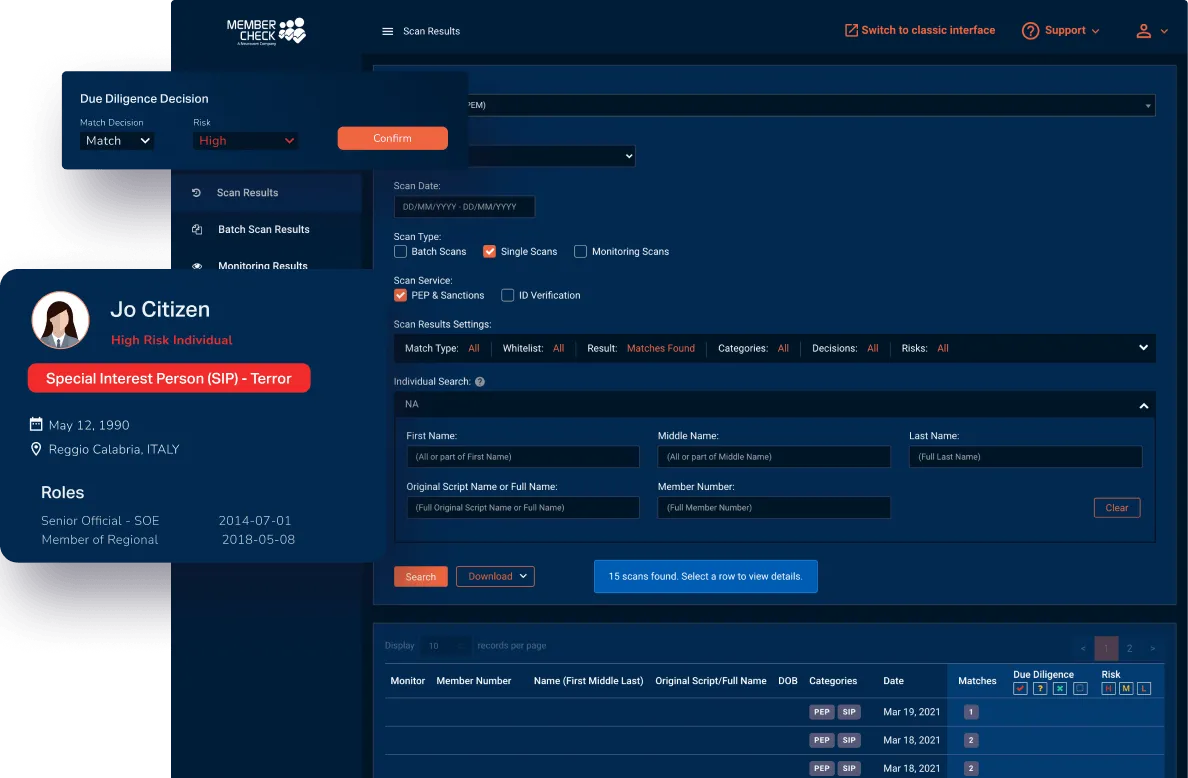

Our clients are provided with a secure and simple solution in regard to scanning for politically exposed or high-risk individuals, as well as checking names against sanction, regulatory, law enforcement, and other official lists.

Use our sophisticated scan filters and due diligence workflow to minimise the amount of time you spend sorting through, false matches. Scan results and reporting sections allow you to access customer details, whenever and wherever required, as well as download reports, to customise for further investigation or to provide evidence of your AML program compliance for auditing purposes.

* This page is intended as general information only and should not be relied on as the sole source of information for your AML obligations and AML program. Please visit your local regulatory authority sites for the latest relevant and full information.