AML/CFT Supervisors in

Isle of Man

Financial Intelligence Unit establishment (FIU)

The Act 2016 established the Financial Intelligence Unit (FIU) as a legal entity (FIU Act 2016). The FIU's mission is to defend the integrity of the Isle of Man's financial system while also assisting in the administration of justice through its expertise in detecting financial crime, money laundering, and terrorism financing.

The FIU is a full member of the Egmont Group of FIUs and follows its Statement of Purpose and Principles for Information Exchange between FIUs. Their responsibilities include receiving, gathering, analysing, storing, and sharing information about financial crime.

Compliance Culture

The Isle of Man is known for being a safe and well-governed jurisdiction. Since 1990, the Isle of Man's legislative framework for anti-money laundering and counter-terrorist financing ("AML/CFT") has been in place and effective.

How to comply AML CTF regulations in Isle of Man?

The Proceeds of Crime Act 2008 is the main piece of AML/CFT law in the Isle of Man which specifies the specific requirements that relevant businesses must meet in order to:

Have appropriate procedures and controls in place

Use a risk-based approach and make the following preparations:

- Business risk analysis, customer risk analysis, and technology risk analysis

Perform customer due diligence and customer monitoring on a regular basis.

Name a money laundering reporting officer ('MLRO') and put in place clear internal and external reporting processes.

Properly maintain records of Disclosures received either internally or externally or through any other FIU enquirers.

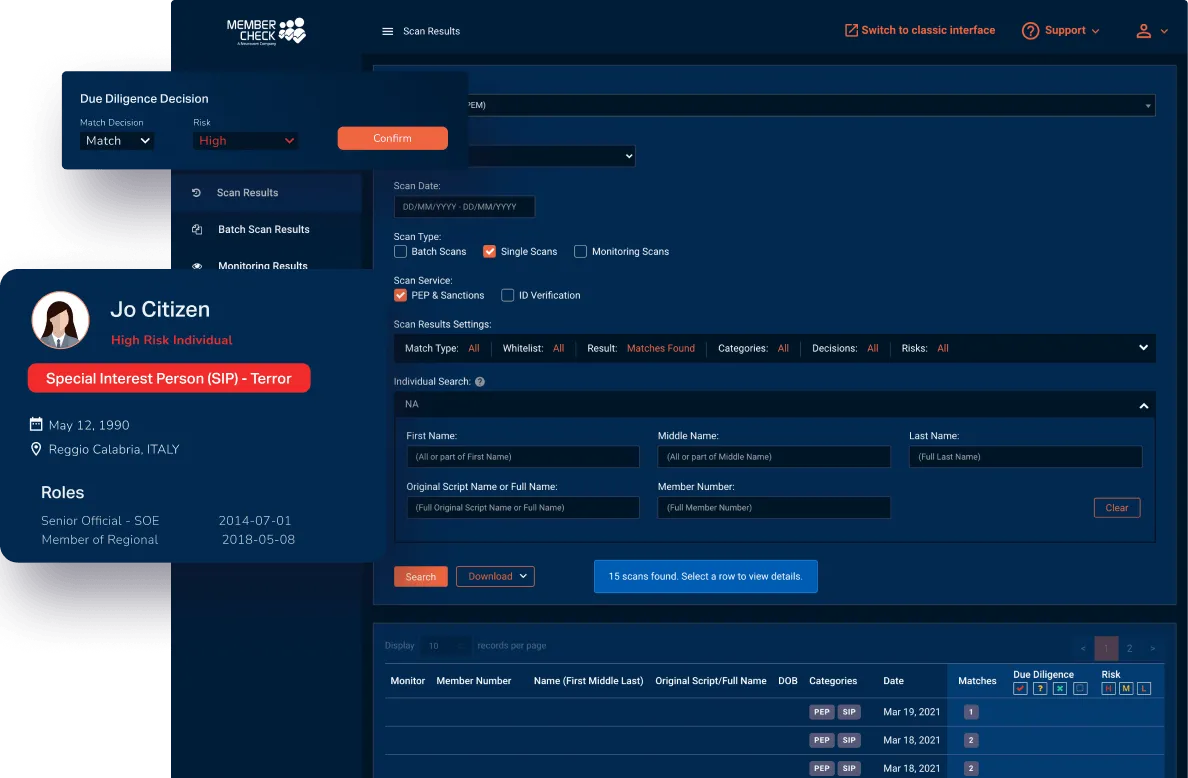

How can MemberCheck Help?

Our clients are provided with a secure and simple solution in regard to scanning for politically exposed or high-risk individuals, as well as checking names against sanction, regulatory, law enforcement, and other official lists.

Use our sophisticated scan filters and due diligence workflow to minimise the amount of time you spend sorting through, false matches. Scan results and reporting sections allow you to access customer details, whenever and wherever required, as well as download reports, to customise for further investigation or to provide evidence of your AML program compliance for auditing purposes.

* This page is intended as general information only and should not be relied on as the sole source of information for your AML obligations and AML program. Please visit your local regulatory authority sites for the latest relevant and full information.