French Polynesia Fight Against AML/ CFT

Financial information is critical to France's fight against money laundering, public-sector fraud, and terrorist financing. Tracfin has built with its partners a cornerstone of this system. As a result, the Financial Intelligence Unit was restructured to develop stronger relationships and better monitor on its reporting activity. In 2019, Tracfin worked on profiles in order to share them with the compliance departments of France's key financial stakeholders, enhancing their detection capabilities.

Anti-money laundering processes in French Polynesia have evolved over time in response to global initiatives as such a Financial Intelligence Unit (FIU) was established to meet these requirements, the FIU is responsible for coordinating between the financial entities and the regulator for the gathering of information and to identify financial transactions that may involve tax evasion, money laundering or some other criminal activity.

The Compliance Code – French Polynesia

In French Polynesia, entities are encouraged to create and implement a comprehensive compliance framework that encompasses all parts of their operations with its customers and regulators. As a result, compliance is the bedrock of confidence between the financial market and its stakeholders, focusing on:

Knowing and following the regulations set by authorities and what it means to act in compliance. The regulations must be communicated in a clear and simple manner.

Compliance with laws, regulations, and ethical principles.

Creating awareness and providing training to all stakeholders on how to avoid the risk of non-compliance and damage to their brand.

Collaborate with clients and partners who adhere to international anti-money laundering and anti-terrorist financing norms and standards.

Build a culture of compliance among its personnel and guarantee that they exercise a duty of vigilance.

The Anti-Money Laundering strategy is a supplement to the traditional approach to crime prevention.

How can MemberCheck Help?

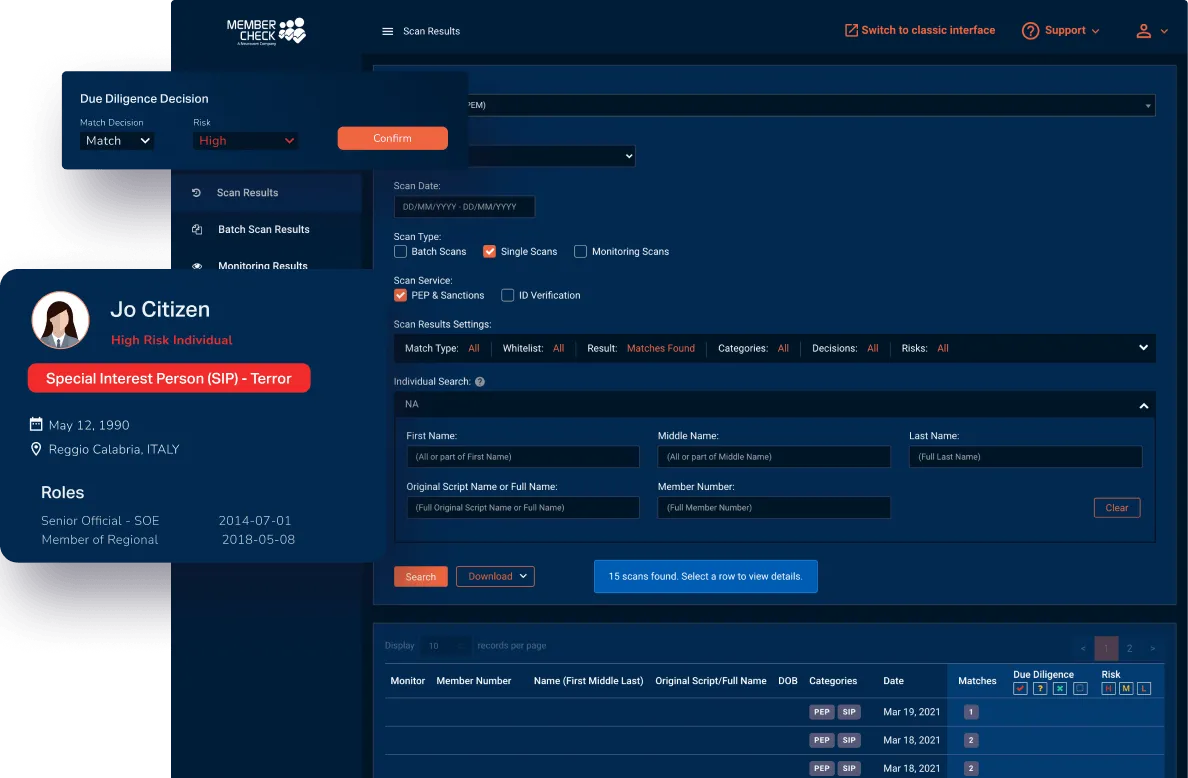

Our clients are provided with a secure and simple solution in regard to scanning for politically exposed or high-risk individuals, as well as checking names against sanction, regulatory, law enforcement, and other official lists.

Use our sophisticated scan filters and due diligence workflow to minimise the amount of time you spend sorting through, false matches. Scan results and reporting sections allow you to access customer details, whenever and wherever required, as well as download reports, to customise for further investigation or to provide evidence of your AML program compliance for auditing purposes.

* This page is intended as general information only and should not be relied on as the sole source of information for your AML obligations and AML program. Please visit your local regulatory authority sites for the latest relevant and full information.